What is Pay It Later?

How does Pay It Later work?

- Enroll in online banking or download the CUTXMOBILE app. Click here to enroll.

- Make a qualifying purchase of $100-$15,0002 at your favorite retailer.

- Navigate to Card Details by selecting your CUTX credit card within online or mobile banking and view Eligible Purchases within Installment Payments.

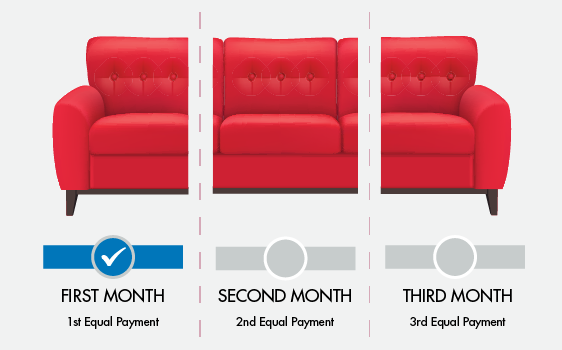

- Pay back your purchase based on the terms you chose for your Pay It Later Installment Payment Plan.

You May Also Be Interested In

Get a good look at where you are and where you're going next.

Financial CalculatorsPay It Later FAQs

What is a Pay It Later Installment Payment Plan program?

A Pay It Later Installment Payment Plan program offers you the ability to pay off eligible credit card purchases over a set timeframe with fixed APR and fixed monthly payments. To review your eligible purchases on your CUTX credit card, access Credit Card Details within CUTX Online Banking and select your CUTX credit card account and then the Installment Payments icon.

How do I create and use a Pay It Later Installment Payment Plan?

You can create a Pay It Later Installment Payment Plan on any eligible purchase. The view eligible purchases on your CUTX credit card, access Credit Card Details within CUTX Online Banking and select your CUTX credit card account and then the Installment Payments icon. If a purchase is eligible, it will display within the Eligible Purchases Tab.

Can an authorized user on my CUTX account create an Installment Payment Plan?

No. Only primary and joint owners of the CUTX credit card account can create a Pay It Later Installment Payment Plan.

What purchases are eligible for enrollment in the Pay It Later Installment Payment Plan Program?

Purchase eligibility for enrollment in a Pay It Later Installment Payment Plan is based on your current annual percentage rate (APR). In addition to your current APR, other factors that determine purchase eligibility include your most recent credit bureau score and payment history. You must have a current credit bureau score of greater than or equal to 605. All purchases must be greater than $100. Maximum amounts will be driven by your current APR and range from $1,000 to $15,000. Eligibility terms include 3, 6, or 12-month duration, but will depend on the purchase amount. For example, a purchase amount of $100 may not have the option to select a 6 or 12-month repayment plan. The terms will be displayed on the screen in Card Details for all eligible purchases.

Are there purchase types excluded from the Pay It Later Installment Payment Plan program?

Yes. Ineligible purchases do not display within the Installment Payment Plan Tab. A few examples of purchases that are excluded from an Installment Payment Plan include previous purchases that are on a monthly statement, disputed/fraudulent transactions, balance transfers, cash advances, international purchases, purchases less than $100 and greater than $15,000, and purchases that post with two-days of the statement cut-off date. Upon acceptance of an Installment Payment Plan, you understand you cannot change or modify the terms.

How many Pay It Later Installment Payment Plans can I create and have active at the same time?

You may have up to 10 active plans on your CUTX credit card account. As you pay off a Pay It Later Installment Payment Plan, you may become eligible to enroll in a new plan not to exceed 10 at any given time. Upon acceptance of the Installment Payment Plan, your account balance will update within two business days. Please note an Installment Payment Plan does not increase your available credit limit. Until the last payment and residual interest is satisfied on an Installment Payment Plan, it will reflect as an active Plan until the billing cycle following full payment.

What happens if I report my CUTX credit card as lost/stolen when I have a Pay It Later Installment Payment Plan?

When you report your CUTX credit card as lost/stolen and you have one or more Pay It Later Installment Payment Plans, the converted purchase will not display in the Eligible Purchases Tab nor the Enrolled Purchases Tab. However, the converted purchase and minimum payment due on the Pay It Later Installment Payment Plan will reflect on your monthly CUTX credit card statement. You may only have 10 Pay It Later Installment Payment Plans at any one time.

Can I create a Pay It Later Installment Payment Plan if the purchase posts within two-days of the statement cycle date?

No. When you have a purchase that posts within two-days of the credit card statement cycle date, that purchase will not show as eligible for the Pay It Later Installment Payment Plan.

What Pay It Later Installment Payment Plan durations terms are available?

When you create a Pay It Later Installment Payment Plan, you will have three duration options to choose from on an eligible purchase. The duration terms available include a 3, 6, or 12-month re-payment plan and include the respective annual percentage rates (APR). The fixed APR will be based on the duration term you select and will display on the screen.

Does the monthly statement display my Pay It Later Installment Payment Plan(s)?

Yes. You will see each Pay it Later Installment Payment Plan listed separately on your monthly statement. The monthly statement displays the installment term, date, and amount of the original transaction of each plan. The monthly statement also displays the monthly payment, fixed APR, balance subject to interest rate, interest charge, and remaining balance of the Installment Payment Plan along with the Interest Avoidance Balance. To review your CUTX credit card e-statement, access Credit Card Details within CUTX Online Banking and select the Statements icon.

How long before a Pay It Later Installment Payment Plan I create reflects on my account?

You will see an eligible purchase you converted to a Pay It Later Installment Payment Plan within two business days from the conversion date. To review your converted purchases on your CUTX credit card, access Credit Card Details within CUTX Online Banking and select your CUTX credit card account and then the Installment Payments icon. Once there, select Enrolled Purchases.

How do I make payments on my Pay It Later Installment Payment Plan(s)?

The Pay It Later Installment Payment program automatically adds the required monthly payment due each billing cycle – there is no need to make a separate payment from your non-installment purchases. When you pay your minimum payment due each billing cycle, you will pay off your Installment Payment Plan balance based on the duration terms you selected. The purchase amount plus interest is divided equally over the term of the Installment Payment Plan each billing cycle. Duration terms include a 3, 6, or 12-month re-payment plan based on the term available and agreed upon by you. Depending on which duration term you choose, you understand your minimum payment may be higher than if you did not select an Installment Payment Plan.

Can I pay off one or more of my Pay It Later Installment Payment Plans early and is there a penalty?

Yes. You can pay off one or more of your Pay It Later Installment Payment Plans early without penalty. When you make a payment in the amount of the New Balance as reflected on your monthly statement, you are paying off the entire Installment Payment Plan balance for each Installment Payment Plan you have selected, including the full balance on non-installment purchases.

What happens when I make a payment that exceeds the minimum payment due?

When you make a payment that exceeds the minimum payment due as reflected on your monthly statement, the difference of the payment amount that exceeds will be applied to the highest interest rate balance first.

What happens if I dispute a purchase that is active in a Pay It Later Installment Payment Plan?

If you dispute a purchase that is in a Pay It Later Installment Payment Plan, your monthly installment amount(s) due will be suspended and will not be charged installment interest until the dispute is resolved. However, this does not suspend payments due on other non-disputed Installment Payment Plans or non-installment purchases.

- When a dispute is denied, this can result in cancelation of the Installment Payment Plan and the calculated minimum due will be based on the standard account balance.

- When a dispute is accepted and when the merchant provides you credit for the dispute, please call us at (972) 263-9497. We will credit your Installment Payment Plan.

Why CUTX?

We're Here To Help

Visit your local branch

We have several locations in DFW and East Texas. Come see us!

times in the previous 12 months. You may have up to 10 active Installment Plans at any time, subject to change at Our sole discretion. You may be able to create Installment Plans on purchase transactions of a specified

minimum dollar amount. This does not include a purchase of cash. Other exclusions may apply. You can only create an Installment Plan if You receive an offer. The offer will tell You the terms, including the APR, that will apply to that Installment Plan. Balance transfers and cash advances do not qualify for Installment Plans. Federally insured by NCUA.